Our businesses

Telecoms

Discover the market for the protection of telecom installations

Introduction

MALTEP accompanies pylonists, park managers, project managers and operators in the security of their telecommunication infrastructures.

French expert in earthing and lightning protection, MALTEP accompanies you in order to propose technical solutions, advice and materials adapted to your projects.

The telecom in numbers

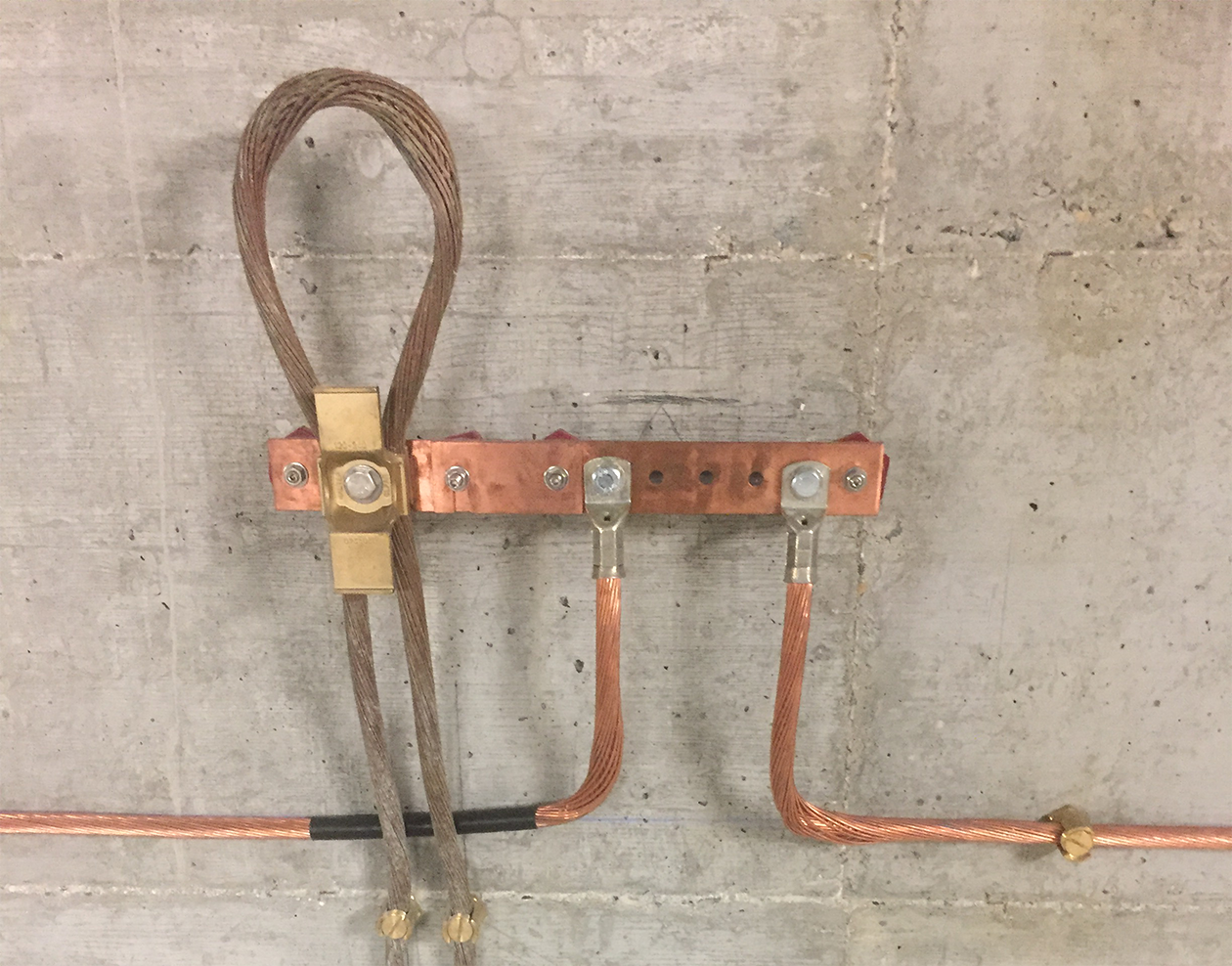

Development and investments

In 2017 90% of the population had access to 4G and 99% could access 3G.

In 2020 network operators invested a total of 115, billion euros in the development of fixed and mobile networks, not including the purchase of 5G frequencies. This represents a 10% increase on the 2019 investment. In addition, according to the 2019 results, €1 invested by operators in HSBB networks generates €6 of GDP.

For the year 2020, 54,333 4G antennas had been authorized by November 1, of which 48,925 were already in service.

The average 4G data consumption has seen an annual increase of 30% between 2017 and 2020, and an increase of around 10% between 2020 and December 2021. In contrast, the share of telecom spending for households decreased by 0.9 points between 2010 and 2019, from 2.8% to 1.9%, a 32% drop in 9 years.

Market recovery and growth

In 2021 the operators' revenue in the retail market has again grown by +2.5% after 10 years of decline.

This growth was mainly due to the recovery in data usage abroad in the second half of the year, as well as to the sale of handsets, which grew by 7% in one year. To a lesser extent, the 4% growth in sales of fixed broadband and ultra-broadband services also explains this recovery.

In addition, this market segment has seen a 5% increase in tariffs in 2021, particularly for DSL offers, which have seen a 7% increase in tariffs, compared with +4% for fiber offers. The latter account for the entire growth in the number of subscriptions. This allowed them to exceed the number of DSL subscriptions. Fiber subscriptions represented 58% of total subscriptions at the end of 2021.

The continued increase in data consumption and the development of 5G, with currently 3 million users, are also contributing to the growth of the telecommunications sector in France. As of December 31, 2021, there were 80 million SIM cards in circulation, 4% of which were active on 5G networks.

Telecoms BtoB

In 2018 BtoB represented 30% of the French telecom market, with a value of €9.8 billion.

In the coming years, the fixed-line market is expected to decline in favor of other segments, notably connectivity and telecom services. The market should therefore stabilize in the coming years.

The democratization of fiber seems to allow the installation of new operators who, like Free in its time, will lead prices to decrease mechanically with the increase in the number of offers available.

86% of the BtoB market is occupied by VSEs, which therefore represent a mane of potential customers for incoming operators, especially since fiber is not yet strongly present there.

Sources: French telecoms federation, ARCEP

MALTEP range

Lightning rods

Lightning rod extension masts

Lightning rod base

Clamp for lightning rod

Fixing clamp for ribbon ties

Stainless steel ribbon ties

Flat and tape conductors

Square Clamps

Anti-vandal metal guard

Tinned copper test joint

Lightning strike counter

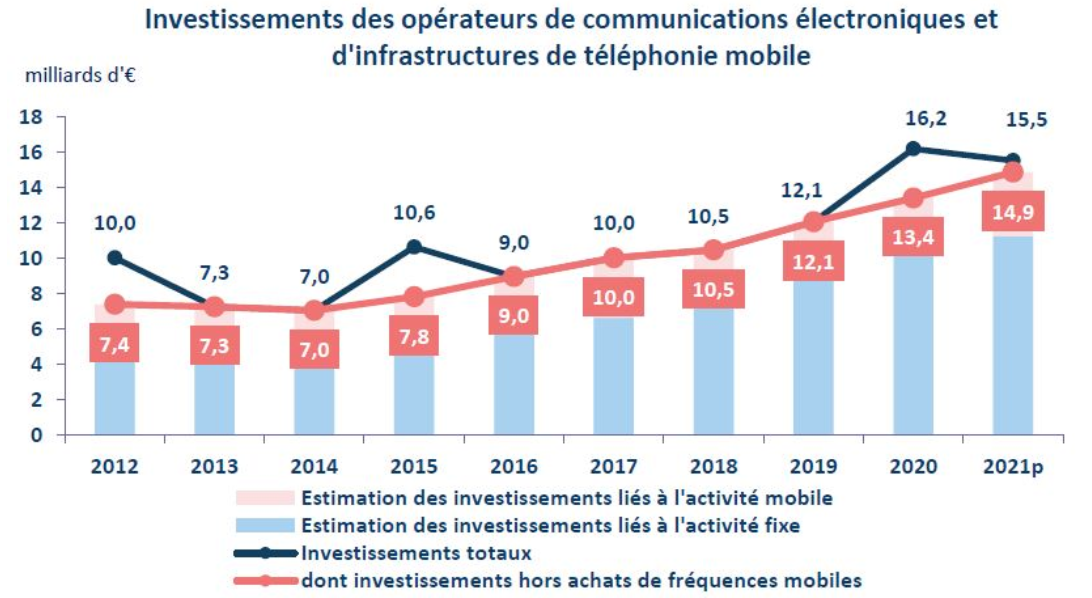

Equipotential earth bars

Equipotential earth bars on rail

Crow foot clamp

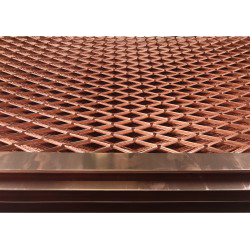

Earth grids with connecting band

Find out more about the protection of telecommunications masts.